Facebook will acquire WhatsApp for over $16 billion, according to the company. This is an objectively enormous amount of money, and far more than Facebook offered for Snapchat. But WhatsApp is — or was — arguably the largest known threat to Facebook. It was one of the only services that could plausibly claim to be cannibalizing Facebook on a large scale, and one of a small few that pose to it an existential threat.

It claimed, as of December, to have nearly half as many users as Facebook. This alone would have been enough to get Facebook's attention, but Facebook, going into 2014, has openly declared itself a mobile company (and by extension, a messaging company). Its future depends on its apps, which include Facebook, Facebook Messenger, Facebook Home, and Instagram — all of which compete directly with WhatsApp.

Facebook reported in January that it had 945 million monthly mobile users, who use the app primary to check News Feed and message each other; WhatsApp currently claims over 450 million monthly active users, who chat with each other, set statuses, set up group chats, send photos and videos, and share voice notes.

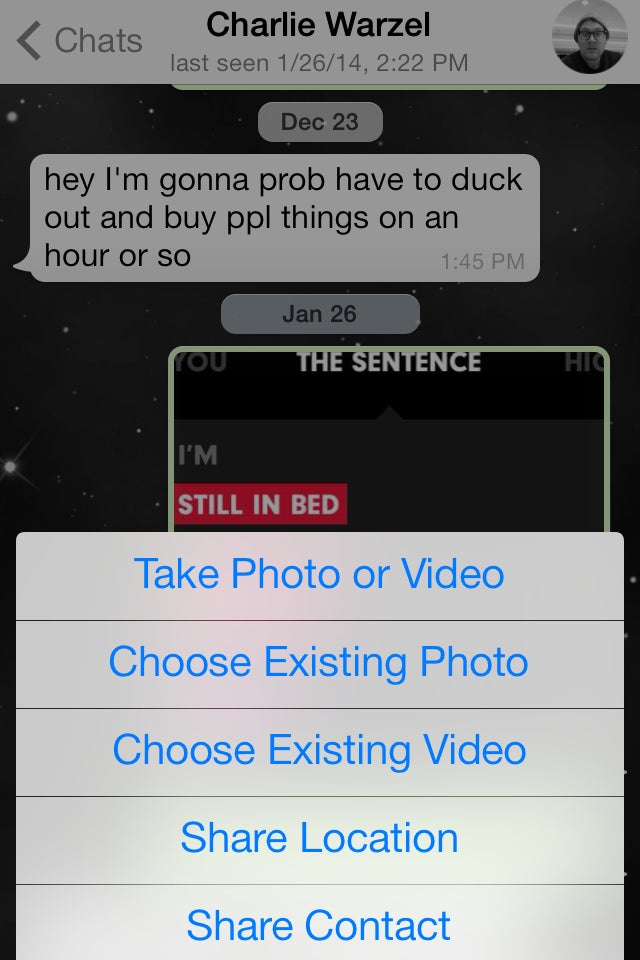

It's a primitive-looking app — maybe even ugly — and it contains no ads. It associates with your phone number and circumvents texting charges; it only takes a few friends to join before its crude, simple appeal is obvious. It feels more immediate than texting and has no messaging limits, which was the key to its early popularity. It's also quite a bit richer than texting and traditional MMS — you can send almost any media on your phone very quickly — without feeling complicated.

There are other popular messaging apps, and perhaps none is more popular than Facebook's (if you include the primary FB app). But over the last year, the rise of apps such as WhatsApp, WeChat, Kik, Line, and Viber have left the incumbent tech giants somewhat stunned. No one of these apps is larger than Facebook. But two of them — WhatsApp and WeChat (which is most popular in China) — are almost certainly larger than Twitter. And together, these stripped-down messaging apps have likely collected more users, and now send more messages, than the entirety of Mark Zuckerberg's portfolio.

The tech giants have so far reacted in different ways. Facebook cloned Snapchat then tried to buy it, both times to no avail. It released a standalone messaging app, however, that has become popular. Instagram added direct messaging to its product and Twitter beefed up its own backchannel service. Google unified all its chat products under the "Hangouts" moniker, the results of which are unclear.

They were, in other words, aware of their new competitors, but it was clear those competitors had taken the driver's seat, and that the tech giants had lost control of messaging. The most recent version of Facebook Messenger, for example, seems to have taken design cues from WeChat and Line, which most of its American users have never even heard of:

This coordinated rush toward messaging has created the illusion that all the tech giants are copying each other. In reality, they were all responding to the same outside threat: the new school of messaging apps, chief among them WhatsApp. Last year, Forrester research analyst Charles Golvin told BuzzFeed's Charlie Warzel, "In places like Brazil, Mexico, Spain… 25% of the time people spend on smartphones, they're spending in WhatsApp. The number is variable for each of those countries, but it is of that magnitude." These were the numbers that Facebook couldn't ignore, describing markets where it still has an opportunity to grow.

The knee-jerk response to this news has been that $16 billion, plus $3 billion more in restricted stock units, seems to be too much money. WhatsApp is unfamiliar to many Americans and its revenue plan — a yearly charge of about a dollar a user, after a free grace period — is modest, so this reaction makes some sense. It's just texting, right?

The most important thing to understand about WhatsApp is just how terrifying it is to a company like Facebook. It can compete with Facebook on its most valuable turf — users' smartphones and text conversations — without exhibiting aggressive business ambition. It's drawing from the same limited pool of attention, and accommodating some of Facebook's most addicting behaviors Facebook claims in its release that WhatsApp is approaching traffic levels comparable to the entirely of global traditional text messaging.

In the process of accommodating these critical behaviors messaging apps threaten to destroy the wealth Facebook and others have become so good at extracting from them. Messaging apps demand attention without creating much revenue; they get the job (of talking to your friends) done and pointedly shun complexity. From a user standpoint, they're efficient. From a social networking company's standpoint, they're worrying. A company like Facebook might view an insurgent messaging app in the way newspapers once viewed Craigslist, as a ruthless and efficient destroyer of value. (From the perspective of a telecom company, for which high captive messaging fees are a major source of profit, they're a potential nightmare.)

There seems to be a hint of panic, or at least haste, in this purchase. In mid-January, just a few weeks ago, WhatsApp's founder claimed that it was "here to stay," and that he wasn't interested in selling. At the time he had not yet entertained the offer that apparently changed his mind, and which is now being called the largest ever deal of its kind. (His co-founder had posted on Twitter in 2009 about failing to land a job at Facebook: "Looking forward to life's next adventure," he wrote.)

The most important companies on the internet spent the last year scrambling to find or become the next great messaging service. Facebook, in particular, had openly declared its obsession with identifying, creating or acquiring the next big thing — the Next Facebook — going so far as to spend $100 million on an analytics service designed to track apps just like WhatsApp, and shutting it down to outside clients.

Today, for a steep price, Facebook just improved its odds.