Coming up on the five year anniversary of the failure of Lehman Brothers and the worst of the financial crisis, has Wall Street gotten any safer for taxpayers? Anat Admati, a Stanford professor and one of the leading advocates for much stricter regulations on how much banks are allowed to borrow, best summed the opposing view when she wrote in The New York Times last month that "nearly five years after the bankruptcy of Lehman Brothers touched off a global financial crisis, we are no safer."

The Obama administration has a different story.

In a briefing with reporters yesterday, a senior Treasury official said that "Wall Street reform is intended to end any concept that a large financial institution will be rescued or that taxpayers will be put on the hook for one in a financial crisis." The official put forward three arguments for why the financial system as a whole is safer, more stable, and that investors are finally getting the message that the government really won't bail out a big bank should it face failure.

1. The biggest banks are paying more to borrow money.

2. Bank borrowing is getting more long term

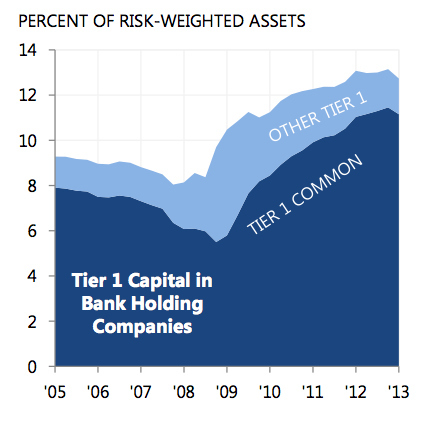

3. Banks are borrowing less