For young people more than anyone else, banking is done without relationships and, ideally, without actual bank branches — more Minority Report than It's A Wonderful Life. According to a survey from Accenture, 39% of 18 to 34 year olds would consider switching to a bankless branch, while 71% of people in the U.S. and Canada view their banking relationship as a transaction, which Accenture defines as "simple transactions like paying bills, checking account statements, etc."

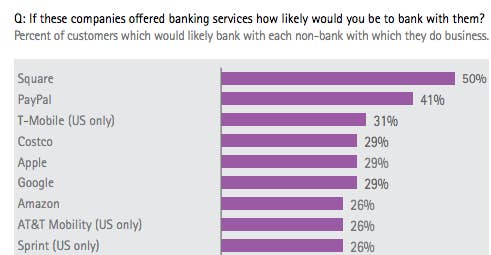

Accenture thinks this depersonalization of many retail banking services provides an opportunity for other types of companies to take that market share away from traditional banks. According to the survey, "nearly half of customers would likely bank with a company they currently do business with but does not currently offer banking services," (like a tech company) which the consulting firm called a "potentially ominous sign." For young people in the U.S. and Canada, the portion was over 72% who would look to bank with a well-known, non-bank company.

Square and PayPal, payment companies with an obvious connection to finance, were listed as the most favored non-traditional bank options, but technology behemoths like Apple, Google, and Amazon did get over 25% support. While Google does do payments and Amazon lends to some merchants, neither have gone into consumer finance in a big way. Apple is persistently rumored to be entering payments, but hasn't made any public moves.

The heavy regulatory burdens are a major barrier for tech companies entering traditional financial services. Even for companies that offer only wealth management and investment advising, getting the proper regulatory approvals can take up to two years. In 2012, no new nationally chartered banks were created. While money has poured into Bitcoin startups, the complex, volatile online cryptocurrency is a tiny fraction of the traditional banking and payments system, and Bitcoin's biggest venture capital investors lament the regulatory burden of financial services companies.

"I sympathize with Jamie Dimon, he runs an over-regulated company," Union Square Ventures partner Fred Wilson said earlier this year, referring to JPMorgan.

But the largest and most traditional banks continue to see their retail business transformed by technology and evolving consumer preferences. Banks have largely stopped building branches and are investing more in going to where their customers are: the internet.

In another recent survey, Bankrate found that more than 30% of Americans and 38% of young people hadn't visited a bank in the last six months. Chase, which has 5,600 branches and the second largest banking branch network, has stopped building out branches, and has seen a 28% increase in online log-ins and 3% and 4% decreases in customer service calls and teller interactions since 2010.

BBVA, the large Spanish bank, agreed to buy Simple, a startup that promised no-fee, basic banking was earlier this year.

But still, even the biggest banks are on the look out for tech companies nipping at their heels. "Look, you'd be an idiot not to think that the Googles and Apples... When I go to Silicon Valley...they all want to eat our lunch, I mean, every single one of them," JPMorgan Chase's chief executive officer said at a presentation in February.