Higher One, the New Haven–based higher education financial services company, announced Tuesday morning that it had reached a preliminary agreement to settle a class-action lawsuit over its fee practices for $15 million. The announcement, made in a regulatory filing two days of ahead of when the company announces its quarterly earnings, would, if approved and finalized, settle at least five separate lawsuits that had been combined into one earlier this year.

The five lawsuits, filed in Alabama, Connecticut, Mississippi, Illinois, and Kentucky, all alleged "unfair and deceptive conduct in the marketing and fee policies of the Higher One OneAccount bank account," according to the order that combined the lawsuits into one class action.

The consolidated class action, also filed against Bancorp, a former bank partner of Higher One and Wright Express, a current partner, claimed that Higher One coercively and improperly "locked" college students into getting debit checking accounts with Higher One and its bank partners in order to access financial aid money used for non-tuition expenses. The consolidated complaint named 12 individual plaintiffs.

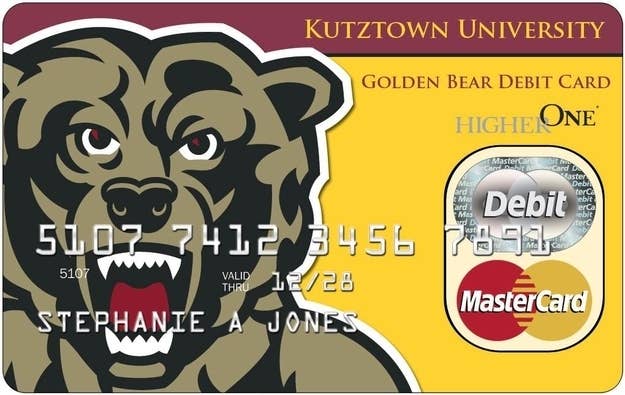

The suit said that the company's marketing practices, including branding their debit cards with a college logo and allegedly making it more difficult for students to opt-out of a Higher One checking account and receive their financial aid refunds through their own bank account, essentially forced students into using Higher One's OneAccount and paying the accompanying fees.

In Tuesday's regulatory filing, the company also said that it would take a $16.3 million charge for the settlement and other legal costs. The settlement still requires court approval. The company also said that the preliminary settlement would include "an agreement to make and/or maintain certain practice changes." When asked what those changes would be, a Higher One spokesperson told BuzzFeed, "Because the company remains in negotiations and the settlement is not finalized, further details cannot be provided at this time."

In a subsequent statement, the company said that "Higher One maintains, and has always maintained, that the claims in the lawsuits are without merit. Higher One has entered into this agreement in principle solely to avoid a lengthy and costly litigation process and to minimize business disruption in offering its valued services to students and institutions of higher education."

The lead attorney for the plaintiffs, Hassan Zavareei, told BuzzFeed this afternoon "I can confirm that we have reached a settlement in principle that would provide substantial relief to the putative class members. The agreement has not been finalized yet, but we are optimistic that we will have a final agreement to present to the Court within the next sixty days."

Higher One has over 2.1 million student checking accounts and, through its financial aid disbursement, payments services, and data analytics, works on college campuses with 4.8 million students.

This is not the first time Higher One has faced litigation because of its marketing practices and fees. Last year, the company paid $11 million in restitution and $110,000 in penalties to the FDIC after the bank regulator alleged that Higher One had charged students multiple fees for having overdrawn accounts and making payments in insufficient funds.

After the settlement, Higher One introduced a new account with fewer fees and simplified its fees schedule. Since then, Higher One's earnings have fallen as the revenue it gets from fees has declined 16%.

Update - Nov. 5, 9:25 p.m., EST: This piece has been updated to reflect a later Higher One statement.