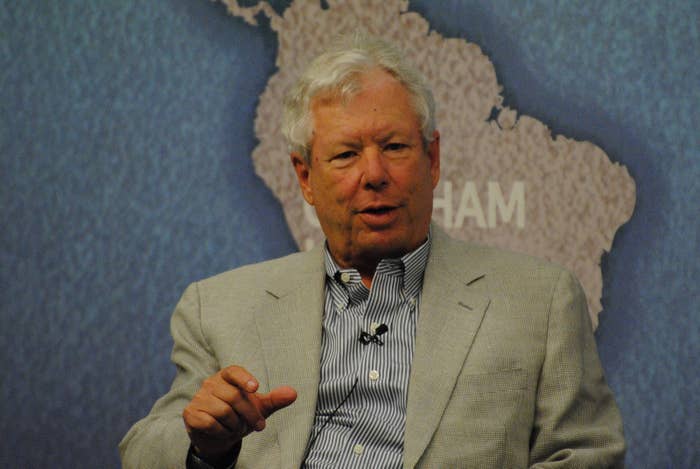

Richard Thaler is the winner of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, commonly known as the Nobel Prize for Economics, for 2017.

Thaler is an economist at the University of Chicago. He specializes in psychology and how people make economic decisions in real-world conditions. His work incorporates psychological research to revise how economic models operate. He is one of the forerunners of what is now known as "behavioral economics," one of the most vibrant subfields in the economics discipline.

Thaler told a press conference Monday morning that the most important impact of his work is the “the recognition that economic agents are human and that economic models have to incorporate that.”

According to the prize committee, “Richard Thaler's contributions have built a bridge between the economic and psychological analyses of individual decision-making. His empirical findings and theoretical insights have been instrumental in creating the new and rapidly expanding field of behavioural economics, which has had a profound impact on many areas of economic research and policy.”

Thaler and a generation of economists and psychologists, including 2002 Nobel Laureate Daniel Kahneman, have worked to revise standard economics models of how people act in markets with evidence from psychology, including laboratory experiments.

“Many of his insights will be familiar with the general public, in fact, some non-economists might be confused to hear that he got a Nobel prize for pointing out that people care about fairness, make mistakes, and inadequately plan for the future,” Betsey Stevenson, an economist at the University of Michigan and the former chief economist of the US Department of Labor, told BuzzFeed News. “But what he did was to incorporate these ideas into economic models and to show systematically what they mean for the decisions that people make on average and how they systematically make mistakes.”

The Economist of Nudges

Richard Thaler’s work came to greater public notice in 2008, when he published the book Nudge with law professor Cass Sunstein. His work on public policy and nudges covered what is known as “choice architecture,” or the way that default options are presented to people. Thaler argued that choices could be arranged to encourage people to make the choice that was better for them or for society as a whole, but still maintain the freedom to make the “bad” choice.

Since defaults are very powerful — people tend to defer to the easiest options — it was incumbent on policymakers, Thaler argued, to think carefully about the choices they present to people.

"The main lesson from psychology on this is that default options are sticky," Thaler said in a 2008 lecture. "Whatever you choose as the default has a very good chance of being selected. If you are the choice architect, you need to spend a lot of time thinking about what those default options should be.”

A classic example of a nudge Thaler looked at was when employers automatically enrolled workers into 401(k) programs, as opposed to having them choose to participate.

“When employees are first eligible for a retirement savings plan, they should be enrolled unless they choose to opt out,” Thaler wrote in the New York Times. “This solves the procrastination problem that keeps roughly a fifth of workers who are eligible for a plan from joining, even when the employer is matching some of their contributions. Companies that adopt automatic enrollment find that few employees opt out initially, or later.”

“Thaler showed that defaults really matter, and thus by changing the defaults we can help people make better decision,” Stevenson said. “In older models, economists would be agnostics about opt-out versus opt-in policies.”

Sunstein, now a professor at Harvard Law School, said on Twitter that Thaler was "an unboundedly rational choice for the Nobel."

Thaler even appeared in the 2015 financial crisis film The Big Short, where he and the pop star Selena Gomez explained the "hot hand" fallacy — the idea many gamblers and sports fans have that just because something has happened a few times in a row, it means that it's likely more likely to happen a subsequent time — at a Vegas blackjack table.

Policymakers across the globe took up Thaler’s work in an effort to improve their own programs without costly or aggressive interventions. Under then–prime minister David Cameron, the United Kingdom set up the “Behavioral Insights Team,” commonly known as the “nudge unit,” for which Thaler served as an academic adviser.

Thaler was born in East Orange, New Jersey, graduated from Case Western Reserve University, and received a PhD in economics from the University of Rochester in 1974. He has worked at the University of Chicago since 1995.

The Economist of Anomalies

Before Thaler started working on public policy, he did influential research on financial economics. He started writing papers on economic and financial “anomalies” in 1987, with a paper that looked at why stocks had better returns in January than the other 11 months.

He surveyed a wide variety of explanations for the effect. Many researchers attributed it to investors selling stocks that had lost value over the year in December so they could realize capital losses that would offset capital gains on their taxes. These stocks would then be cheap buys in January thanks to the December selloff.

The only problem for this theory, Thaler noted, was that the January effect showed up in countries with no capital gains tax and in countries with tax years that did not end in December. "Securities markets are thought to be the most efficient of all markets," Thaler wrote. If even those could behave irrationally, what about the rest of us?

He would write more than a dozen of these papers for the flagship Journal of Economic Perspectives, which helped establish his behavioral approach in the field.

These anomalies were empirical examples of people behaving in a way that violated the assumptions economists made about rationality, especially with money or in markets. Thaler would typically take a standard economic theory, bring up contrary evidence, and then suggest a psychological explanation for what was really going on.

"Thaler analyzed financial data that were systematically surprising to traditional finance theorists — "anomalies" — and showed that they could be simply and elegantly explained with behavioral models," John Coates, a professor at Harvard Law School, told BuzzFeed News. "And he did it repeatedly, building up so many examples the neoclassical folks lost credibility as they tried to respond to each one."

The Economist of Constraints

Thaler's work on how people spent and saved over their lifetimes was cited by the committee. The existing theory at the time was called "life cycle" theory: It basically said that people spent each year what they could afford based on their lifetime income, net worth, and future income. "The theory is simple, elegant, and rational," Thaler said in a 1990 paper, but had very little empirical backing.

In reality, people seemed to both spend too much and too little. The young were consuming less than their future income would allow for, while people in their high-earning years would spend too much considering their income will soon fall off in retirement. And people tended not to dip into stores of wealth, like home equity or retirement savings, to spend in the present, even if they could. The theory's proponents suggested that what was really happening was that people could not borrow enough to bolster their income.

Thaler's explanation wasn't that something was going wrong in the credit markets, but that people's spending and savings decisions were shaped by their own psychological limitations and aversion to debt. People created "mental accounts" for spending in the present and saving for the future and tended not to use one to bolster the other, except in times of stress.

"The life-cycle theory assumes that individuals solve for the optimal

consumption plan, and then execute it with will of steel. In real life, people realize that self-control is difficult," Thaler wrote.

People, Thaler argued, exhibited a kind of dual psychology instead of constantly calculating how their present spending related to their future income. One way of explaining this was the "planner-doer model," which he formulated in a 1981 paper with Hersh Shefrin.

Thaler argued that people would sometimes make decisions as "planners" with the knowledge that, at any given time (as "doers"), they would likely only be concerned with the present. But people's ability to plan for the future was both limited and exhaustible, and so it was often better to apply simple rules or constraints that were not mentally difficult to comply with.

Social Security, pension plans, or 401(k)s are ways people in the present could control their actions in the future, by forcing themselves (or being forced) to save. Otherwise, they are likely to just spend what they have. And certain rules of thumb, like keeping a few months of expenses saved for emergencies, could be seen as a way for the "planner" to protect the "doer" from spending all their income.

The more simple the rules of thumb, the easier they are to enforce. Like Odysseus binding himself to the mast of his ship in order to resist the Sirens, people can anticipate their own weak self-control and then limit their own options in the future.

Another observation Thaler made was that one-time windfalls, like bonuses, tend to be spent quickly and freely. But windfalls that are changes to the value of an asset that does not immediately generate cash, like when a stock soars in value, tend to be saved and not spent.

Thaler will now have the chance to test this theory on himself. He will receive a 9 million Swedish krona payment, or about $1.1 million. When asked about what he would do with his prize money, he said, “I will try to spend it as irrationally as possible.”

The Economist of Loss

Another one of Thaler’s early key insights was the discovery and explanation of the “endowment effect,” or the idea that once people have something, they place more value on it than they do on items they don’t have, but would like to acquire.

One early experiment Thaler looked at concerned lottery tickets: Participants would be given $2 or a lottery ticket, and then would be offered one for the other. Very few would take the trade, even though the amount of money one is expected to get from a single lottery ticket is far below $2 and besides, you could always just buy another one with the money.

“The main effect of endowment is not to enhance the appeal of the good one owns, only the pain of giving it up,” Thaler, Kahneman, and Jack Knetsch wrote in a 1991 paper. “Foregone gains are less painful than perceived losses,” the three wrote.

Existing economic models assumed that, for example, people would be willing to risk losing 50 cents for a high probability of winning a dollar or two. The only problem is that, empirically, this rarely happens. Thaler and others argued that the endowment effect stemmed from “loss aversion” — that people fear losses more than they appreciate equal or even greater gains.

“Choices are best explained by assuming that the significant carriers of utility are not states of wealth or welfare, but changes relative to a neutral reference point.” the three wrote in 1991.

In other words: People are human.