The saga of BlackBerry is mercifully nearing an end, as the first offer to purchase the company has finally come out.

The company has received an offer to sell itself for $9 a share, which totals about $4.7 billion, to Fairfax Financial, a holding company. Fairfax currently owns approximately 10% of the company. BlackBerry is still allowed to consider other proposals, but its value is a far cry from when the company had a stock price in the hundreds of dollars.

The sale would bring to a close a traumatic year for the company, which released a new smartphone that ended up costing BlackBerry nearly $1 billion and failed to return the company to relevance alongside the iPhone and Android devices.

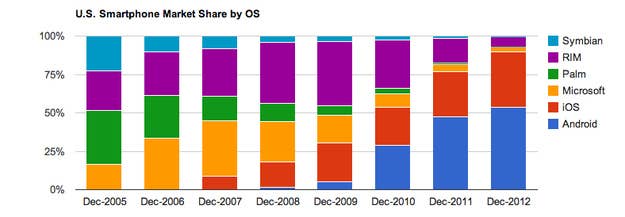

The company's stock has basically dived alongside its market share as competing smartphone providers have seen their value increase dramatically.

BlackBerry has been actively searching for buyers and considered selling off or spinning out its most popular assets, like its BlackBerry Messenger service.

Since BlackBerry is allowed to consider other offers, this could turn into a huge bidding war, similar to the way that a deal to take Dell private turned into a battle with billionaire hedge fund manager Carl Icahn. But this marks one of the first steps of the official end of BlackBerry as the public knows it.