Student debt isn't nearly as big of a problem as it seems — or so says a controversial new report released Tuesday by the Brookings Institution. The study, however, is at odds with recent scholarship and political rhetoric, which paints a picture of a growing student debt crisis and its potentially dire consequences for the economy, and as a result has been subject to heavy criticism.

The New York Times' David Leonhardt wrote up the report, tweeting that "the worries are exaggerated." The Brookings report found that "typical borrowers are no worse off than they were a generation ago." Though the media tends to focus on borrowers with huge outstanding balances, debt burdens over $50,000 are relatively rare, making up just 7% of borrowers, and average loan payments have stayed almost flat over the past two decades, the report claims.

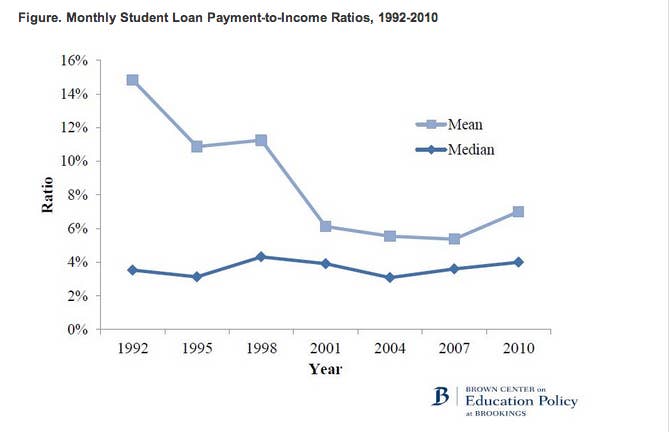

While the average debt burden has risen, the report says, much of that rise has kept pace with growing incomes: In 1992, the average borrower had to devote 3.5% of their income to loan payments, and that figure climbed only slightly to just 4% in 2010. It was actually higher in 1998.

"The sky is not falling," said Brookings' Matthew Chingos, one of the study's authors. "There are some real problems, but people have been getting ahead of themselves, saying that the amount of debt on its own has become a huge problem." Chingos said he, too, was "surprised" by the report's findings, given the media's heavy focus on the increasing number of students with unmanageable debt levels.

But critics say the report uses flawed data to reach its conclusions, distracting from a very real and widely documented debt crisis. The Awl went so far as to call the report "garbage" because of the source of its data.

For starters, the report only includes households "headed" by 20- to 40-year-olds, which likely excludes the significant portion of young adults — 1 in 5 — who live at home with their parents. The 20- to 40-year-old age range, meant to be a "broad sample," according to Chingos, also dilutes the heavier debt burdens of those in their early to mid-twenties, especially those who attended school during and after the economic crisis, critics say.

Further, the data on average monthly payments also excludes those who are in deferral and can't make their monthly payments. Some 11% of borrowers are delinquent on their student loans, according to data from the New York Fed. That Fed data, which counts borrowers, rather than households, found that 14% of borrowers have debt loads over $50,000, twice as many as the Brookings report concluded.

"The people they're missing in the study are those who miss their loan payments -- and are likely to have the highest debt burdens relative to their income levels," said Michael Konczal, a fellow at the Roosevelt Institute.

The Wall Street Journal's Josh Zembrun tweeted:

Also, using student loan data from 2010 is real problem. Imagine if in 2004 you were looking at 2000 subprime data. It'd be pointless.

Chingos dismissed many of the criticisms of the Brookings report, saying that the exclusion of those living with their parents is "unlikely to have an impact" because there is little relationship between the level of debt and whether young people live at home. He said he is "skeptical" that the addition of 2013 data, which is not yet available, would have shown any significant difference in debt burdens.

Konczal pointed to problems that went beyond the study's data. "They're looking at month to month, but what we care about is peoples' lives," Konczal said. "There's a lot of studies saying that people with student debt are less likely to work in the public sector or nonprofits, or start their own businesses. That means they may still be able to make their monthly payments, but that doesn't capture other wealth and employment issues."