The final version of the Republican tax bill won't increase taxes on graduate students who get breaks on their tuition, a provision from an earlier bill that sparked a nationwide uproar from students who said the proposal would unfairly tax them on money they never saw.

The provision in the tax legislation passed by the House would have counted graduate students' "tuition waivers" as income, dramatically driving up their tax bills. A student pocketing less than $20,000 from a school stipend, typical of those in graduate programs, would have suddenly found themselves paying taxes on $50,000 or $60,000 in income.

But the provision, which wasn't in the version of the bill the Senate passed earlier this month, was struck from the final compromise version, released Friday. So was another controversial provision from the House's version, which would have repealed a tax deduction for interest paid on student loans.

Republicans plan to vote for the bill in both the House and Senate next week.

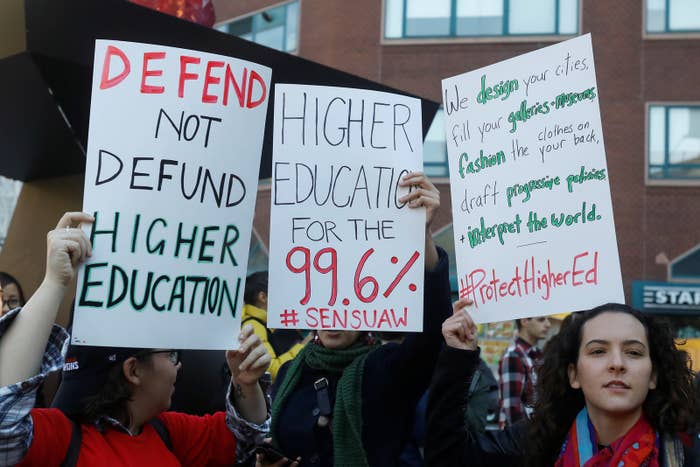

In protests nationwide at more than 40 colleges, graduate students, professors, and higher education leaders argued the House's bill would have transformed graduate education, making it unaffordable particularly for low-income students.

"The fact that thousands of graduate students across the country got engaged in this is an enormous statement about how important they saw this as," said Steven Bloom, the director of government relations at the American Council on Education (ACE), an industry group. "I have to give them enormous credit — they took the bit and ran with it."

Higher education industry groups like ACE, which are powerful forces in Washington, lobbied intensely to convince lawmakers not to tax tuition waivers, saying that schools would also be forced to admit fewer graduate students, and that undergraduates, too, would suffer. "Its ripple effects were enormous," said Bloom.

The final tax bill keeps one provision that had stoked controversy among higher education leaders, imposing a tax on the endowments of some rich nonprofit colleges, a provision conservatives argued would raise revenue from elite schools with billions of dollars in assets.