Liberty Media's John Malone and Comcast's Brian Roberts

Despite its hundreds of millions of subscribers and hundreds of billions in annual revenue, the U.S. cable television industry has always been a mom-and-pop operation. Not unlike the Hearst, Murdoch or Graham family dynasties of the newspaper industry, the cable industry is controlled by a few very powerful, if less recognizable, families.

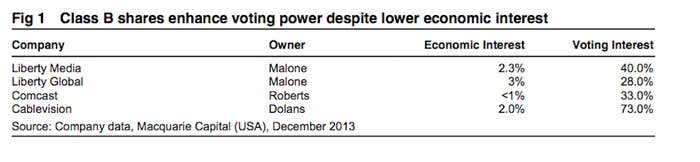

Thanks to dual class voting structures, Comcast's Roberts family, Cablevision's Dolan family and Liberty Media's John Malone, among others, have been able to retain ironclad control of their companies even though they are public and, in theory, owned by shareholders. (See the chart below from a report by Macquarie Equities Research for a breakdown of family economic vs. voting interest.)

Indeed, the lack of family ownership, and therefore voting control, is part of the reason why Time Warner Cable, the nation's second-largest cable TV distributor with 12 million subscribers, is currently being targeted for a takeover. And it is no coincidence that the two most likely buyers of it, either independently or in tandem, are Comcast and Liberty Media.

As the second chart below illustrates, Malone and the Roberts family have both reshaped and risen to the top of the cable TV industry through dealmaking. And while the Dolan family hasn't been very active dealmakers, they have been pioneers in terms of industry innovation.

But as technology has reshaped the industry, many cable TV families have followed the lead of their newspaper counterparts and exited the business in recent years, leading Macquarie Equities Research analyst Amy Yong to speculate in a note this week that the Dolan family may seek to leverage the interest in Time Warner Cable to "enter into the M&A mix and use this opportunity to sell."

It should be not at all surprising that if that were to happen, the Roberts family or Malone would be the most likely buyers.